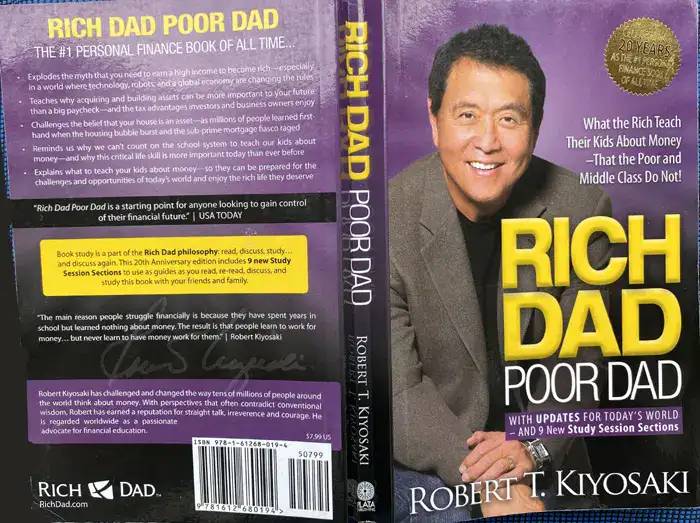

Rich Dad, Poor Dad by Robert Kiyosaki is a financial literacy classic that has inspired millions of readers worldwide. Through the contrasting financial philosophies of his own father (Poor Dad) and his friend's father (Rich Dad), Kiyosaki offers invaluable insights into building wealth and achieving financial independence. Video of Rich Dad, Poor Dad by Robert Kiyosaki About the author, Robert Kiyosaki Robert Kiyosaki, the author of the international bestseller "Rich Dad, Poor Dad," was born in Hilo, Hawaii, in 1947. His father, who was a schoolteacher and government employee, often struggled to make ends meet. This experience significantly influenced Kiyosaki's ...

Home » Reading Practice in English » Rich Dad, Poor Dad: A Timeless Guide to Financial Freedom

Rich Dad, Poor Dad: A Timeless Guide to Financial Freedom

Updated: by Dr. Mohammad Hossein Hariri Asl

Time to Read: 6 minutes | 305 Views | 4 Comments on Rich Dad, Poor Dad: A Timeless Guide to Financial Freedom

Share This Post

About the Author

Dr. Mohammad Hossein Hariri Asl is an English and Persian instructor, educator, researcher, inventor, published author, blogger, SEO expert, website developer, entrepreneur, and the creator of LELB Society. He's got a PhD in TEFL (Teaching English as a Foreign Language).

Number of Posts: 4243

I believe that financial education is something that we never truly learn at schools or universities.

Even some people with university degrees are having trouble finding a proper job and having a sustainable income.

So it would be nice if we could gain some advice from other sources such as books or get counsels from elder people.

Therefore, to become financially independent, we need to rely on additional sources or learn how to think outside the box and be creative in order to open new channels of income and prosperity.

I do not totally agree with all items mentioned in the book as a way to build significant wealth e.g. making money by being just the dealer. But the concept of making a distinction between income and assets and also the stress that the writer puts on the importance of financial planning to achieve long-term financial success and financial independence are interesting and deserve reading and thinking about. ( Dr. Houshmand)

Overall, I believe the book, Rich Dad, Poor Dad, is overstated. As I said in the class, there are a great deal of other excellent books in the field of business and financial freedom that have received less credit and acclaim.